Poultry seller at the morning market in Chokwe, Gurue, Mozambique (photo credit: ILRI/Stevie Mann).

From dairy cooperatives, text messaging and grain storage to improved credit, transport and trade initiatives, a new book presents ‘high-payoff, low-cost’ solutions to Africa’s underdeveloped agricultural markets and chronic food insecurity.

As a food crisis unfolds in West Africa’s Sahel region, some of the world’s leading experts in agriculture markets say the time is ripe to confront the ‘substantial inefficiencies’ in trade policy, transportation, information services, credit, crop storage and other market challenges that leave Africans particularly vulnerable to food-related problems.

‘We can’t control the weather or international commodities speculators, but there are many things we can do to improve market conditions in Africa that will increase food availability and help stabilize food prices across the continent,’ said Anne Mbaabu, director of the Market Access Program at the Alliance for a Green Revolution in Africa (AGRA), which has invested US$30 million over the last four years to improve market opportunities for Africa’s smallholder farmers.

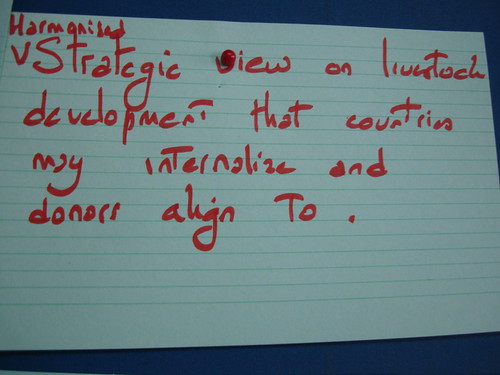

AGRA and the Nairobi-based International Livestock Research Institute (ILRI) have just released a book that features a range of studies that collectively make a compelling argument for embracing agriculture-oriented market improvements as crucial to not only avoiding future food crises but also for establishing a firm foundation for rural development and economic growth. The research was originally prepared for a conference in Nairobi in which 150 experts from around the world discussed how to ‘leverage the untapped capacity of agricultural markets in Africa to increase food security and incomes.’

Its publication comes as international aid groups are rushing assistance to Niger and other nations of the African Sahel—a narrow but long belt of arid land south of the Sahara that stretches across the continent—where a combination of high food prices and poor weather has left some 14 million people without enough to eat. The food problems in the Sahel are emerging just as African governments and aid groups say they have stabilized a food crisis in the Horn of Africa that at its peak in Somalia had left 58 percent of children under the age of five acutely malnourished.

But while volatility in international commodities markets is being widely cited as a major cause of the food shortages in the Sahel, there is growing evidence that at least some of the food price fluctuation in Africa is caused by domestic factors.

Recent research—led by Joseph Karugia, Coordinator of the Regional Strategic Analysis and Knowledge Support System for Eastern and Central Africa (ReSAKSS-ECA) at ILRI, and colleagues at the Association for Strengthening Agricultural Research in Eastern and Central Africa (ASARECA)—examining food price volatility in Eastern Africa suggests domestic factors are playing a role as well. The researchers found that over the last few years, even when global prices have receded, domestic prices in the region have remained high. For example, while global maize prices declined by 12 percent in the last quarter of 2008, in Kenya, Tanzania, Ethiopia, Zambia and Rwanda, they increased.

The study finds food price volatility in these countries is at least partly due to barriers and policies impeding the flow of food among markets in the region and between the region and global markets.

‘We need to consider what can be done within Africa to reduce our vulnerability to food-related problems,’ said ILRI’s interim deputy director general for research Steve Staal, an agricultural economist with expertise in smallholder farming systems. ‘Improving regional and sub-regional agriculture markets is one way we can increase food security and the impact of even minor improvements could be impressive. Just as it doesn’t take a big rise in food prices to tip millions of Africans into poverty, it does not require a sharp move in the other direction to generate huge benefits.’

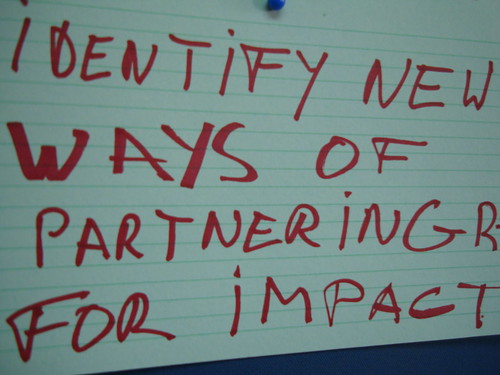

The book from the markets conference outlines a number of ‘high-payoff, low cost’ initiatives that combine ‘innovative thinking’ and ‘new technology’ along with policy reforms to give farmers an incentive to boost production—and the means to make their surplus harvests more widely available and at an affordable cost.

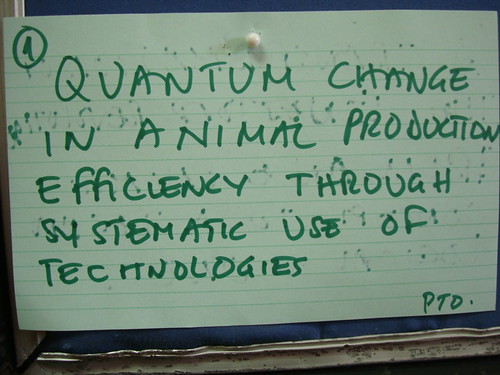

For example, the Smallholder Dairy Project, a collaborative project between ILRI and research and development partners in Kenya, catalyzed some 40,000 small-scale milk vendors to generate an extra US$16 million across the Kenya dairy industry by seeking policy changes and providing practical training that made it easier for them to comply with national milk safety and quality standards. Prior to the initiative, smallholder dairy farmers were not realizing either their production or income potential because complex and costly food safety standards reduced participation in formal milk markets.

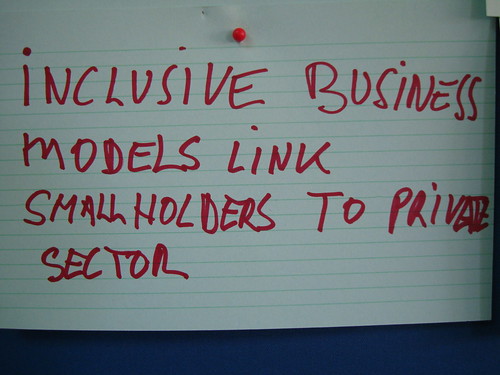

‘Smallholder farmers and herders in Africa need a combination of investment in infrastructure and services, along with regulatory changes to take full advantage of growing agriculture market opportunities,’ said Staal. ‘And since smallholders produce most of the milk, meat, vegetables and grains consumed in Africa, improving their participation in agriculture markets—particularly as populations gravitate away from rural areas to urban centers—is key to the continent’s food security.’

For example, a warehouse receipt program operated by the Eastern Africa Grain Council and Kenya’s Maize Development program is offering farmers two things they previously lacked: a place to safely store surplus harvests and easier access to credit. Research has shown that on average, 25 to 50 per cent of crops produced on African farms spoil in the fields and in East Africa alone up to USD90 million worth of milk is lost per year due to spoilage.

Lack of credit is also limiting the ability of African farmers to produce and sell more food. One important aspect of the warehouse receipt program is that it allows farmers to get credit using the deposited grain as collateral. They can use the credit to purchase such things as farm inputs for the next planting or meet immediate cash requirements.

‘We understand that credit is crucial for expanding production on African farms—as it is everywhere in the world—which is why AGRA is working with commercial banks to unlock millions of dollars in loans for smallholder farmers across Africa,’ said Mbaabu.

AGRA’s partnerships with Standard Bank, NMB Bank (Tanzania), and Equity Bank (Kenya) were modeled on an initiative by the Rockefeller Foundation in Uganda that had only a 2 per cent default rate. ‘This shows that investing in African farmers makes good business sense,’ said Mbaabu.

The book also discusses initiatives that are using post-harvest processing facilities and information technology to improve market opportunities. An analysis of processing facilities in Tanzania that make chips and flour from cassava—a crop many smallholder farmers can produce in abundance—found that they were profitable even when dealing at 50 per cent of capacity. Research in Northern Ghana found farmers were getting 68 per cent more for their harvests after using a service that provides a steady stream of pricing, market, transportation and weather information via text message.

On the policy front, the market experts see an urgent need to confront the ‘hodge-podge of tariffs’ and the numerous export restrictions and customs requirements that make it hard for areas of Africa where there are food surpluses to serve those in food deficit. Critically, they recognize that private investors are in many cases playing the lead role in new investments for market development and services.

Policy-makers need to shift emphasis from a traditional regulatory approach to one of co-investment to leverage private sector activity, supporting appropriate infrastructure and information systems,’ says Staal.

A recent report from the World Bank on trade barriers in Africa recounted how in Zambia, the grocery store Shoprite spends USD20,000 per week securing import permits for meat, milk and vegetables. And its trucks carry up to 1,600 documents to meet border requirements. Overall, the Bank report estimates African countries are forfeiting billions of dollars per year in potential earnings by failing to address barriers to the flow of goods and services.

‘When many people think of a food crisis in Africa, they picture crops withering in the field or dead or dying livestock, but rarely do they think about the market issues that are part of the problem as well,’ said Namanga Ngongi, president of AGRA. ‘African farmers face many challenges in the field and pasture but they will continue to lack the means and the incentive to boost crop and livestock yields if we continue to neglect our underdeveloped agriculture markets.’

The book, African agricultural markets: Towards priority actions for market development for African farmers, and synthesis document are available for download here.

The Alliance for a Green Revolution in Africa (AGRA)

is a dynamic partnership working across the African continent to help millions of small-scale farmers and their families lift themselves out of poverty and hunger. AGRA programmes develop practical solutions to significantly boost farm productivity and incomes for the poor while safeguarding the environment. AGRA advocates for policies that support its work across all key aspects of the African agricultural value chain—from seeds, soil health and water to markets and agricultural education.

The International Livestock Research Institute (ILRI)

works with partners worldwide to help poor people keep their farm animals alive and productive, increase and sustain their livestock and farm productivity, and find profitable markets for their animal products. ILRI’s headquarters are in Nairobi, Kenya; we have a principal campus in Addis Ababa, Ethiopia, and 13 offices in other regions of Africa and Asia. ILRI is part of the CGIAR (www.cgiar.org), which works to reduce hunger, poverty, illness and environmental degradation in developing countries by generating and sharing relevant agricultural knowledge, technologies and policies. This research is focused on development, conducted by a Consortium of 15 CGIAR centres working with hundreds of partners worldwide, and supported by a multi-donor Fund.

More on the book

Download the full book or individual sections